Table of contents

Table of contents

The complete guide to UX research

In this guide, you’ll learn:

- What UX research is and why it is essential to understand user problems and opportunities

- The main types of UX research data and methods, from qualitative vs quantitative to attitudinal vs behavioral, and when to use each

- How UX research fits into the product lifecycle, from early discovery and concept exploration to testing and post-launch learning

- How to centralize and organize research data using tools like affinity mapping and AI-powered clustering in Miro

- How to do UX research, choosing methods based on your goals, product stage, and real-world context

Try Miro now

Join thousands of teams using Miro to do their best work yet.

UX research is one of the most crucial ingredients in designing a good user experience. It’s the practice of understanding users - their needs, behaviors, and motivations - so teams can design products that actually work for the people using them. By grounding decisions in real user insight, UX research helps teams reduce risk, avoid costly rework, and build experiences that feel intuitive rather than assumed. That’s why, after my years of experience at Turtle, I've created this guide as a foundation for understanding what UX research is, the impact it can have, the main research methods teams use, and how to choose the right approach at different stages of the research and design process.

Introduction to UX research

Designing user experiences is kind of like feng shui for your app or website: it’s all about creating an optimal experience that’s delightful, logical, and tailored to a user’s goals and needs. UX research is one of the most crucial ingredients to doing this well. More and more companies are realizing that research can’t be skipped, because answering critical questions about your users – and adopting a user-first approach to design – leads to more satisfied customers and fewer inefficiencies.

That’s why, after my years of experience at Turtle, I've created this guide as a foundation for understanding the impact UX research can have, and the steps you should take to start to incorporate UX research into your research and design process.

What is UX research?

User experience research is a systematic approach to understanding a user’s perspective. It’s about diving deep into how people interact with a product, observing how easily they can complete their tasks, and whether their goals are truly being met.

Through UX research, teams can uncover user behaviors, needs, and motivations via observation, task analysis, and other types of user feedback.

There are a number of different methods that fall under the umbrella of UX research, from usability studies to interviews and focus groups. But, they all share the same goal: building a deeper, evidence-based understanding of users.

Why UX research is important

User-centered design – where teams involve users in every stage of the design and development process – is now widely recognised as essential to building effective products. According to research from PWC, 59% of consumers feel that companies have lost touch with the human element of customer experience, highlighting the importance of doing UX research to find these customer pain points and being aware of what the customers are thinking. .

At its core, it’s about empathy: the key to understanding what users are actually thinking, feeling, and trying to achieve, rather than designing based on assumptions or internal opinions. UX research provides the evidence teams need to move beyond guesswork, reduce risk, and design with confidence.

UX researchers act as a bridge between customers or users and the teams building products, including product, engineering, and company leadership. They distill learnings from their research into easily digestible stories and visual artifacts that help teams validate assumptions, evaluate solutions, assess the impact of a product, and design experiences grounded in real user needs.

Over time, these insights support better decisions across the product lifecycle and can even influence a company’s broader product and business strategy. Take it from Summer Kim, Head of User Research at WhatsApp:

“As a user researcher, my mission is to humanize data and spread impactful and memorable user stories, so we make products and services that matter to people, companies, and their missions.”

In practice, UX research gives you:

- Insight into what users want and need, and why

- An understanding of how users interact with a product, not just how teams expect them to

- A foundation for how to design your product that directly addresses real user problems

- Data to make better-informed design and product decisions

- Insight into your return on investment and measurable business outcomes

From a business standpoint, the benefits of UX research are clear. Uncovering usability issues, unmet needs, performance bottlenecks, and moments of friction early, teams can prevent churn before it happens and focus investment on what users actually value.

Products grounded in this research tend to deliver higher user satisfaction, improved retention, and stronger long-term growth.

What are the different types of UX research data?

UX research data generally falls into a few key categories. Understanding the differences helps teams choose the right methods for their goals and avoid relying on a single type of insight.

Qualitative vs. quantitative UX research

At the beginning of your research process, you’ll be thinking about your goals and what you’re trying to discover. Are you trying to measure something? Or gain more high-level insights? That’s where the distinction between qualitative and quantitative research methods becomes important.

Quantitative research focuses on scale and measurement. It helps teams understand how many users are affected by an issue, how often something happens, or where users drop off in a journey.

Common quantitative methods include surveys, analytics, A/B testing, and funnel analysis. Product managers, growth teams, and analysts often rely on quantitative data to prioritise work and track performance over time.

Qualitative research, on the other hand, explores the reasons behind user behavior. It helps teams understand why users act the way they do, what they’re struggling with, and how they perceive an experience.

Methods such as user interviews, usability testing, diary studies, and field research are typically used by UX researchers and designers to uncover motivations, mental models, and unmet needs.

As UX researcher Laura Klein puts it:

“Quantitative research tells you what your problem is. Qualitative research tells you why you have that problem.”

As an example, imagine you run a test and discover that over 99% of users who sign up for your service don’t complete the purchase process. When you analyze the data, you find that the majority of users drop off at the Payment & Billing page. You’ve just done quantitative research to pinpoint a problem.

Now you need to understand why it is happening. You can use more quantitative data, like an A/B test, to try changing up the experience of the page until you get more conversions. You can also dig deeper into understanding why users are not converting by leveraging qualitative data.

Conducting user interviews, focus groups, or usability studies can reveal moments that create hesitation, frustration, and loss of trust. Maybe users are confused by pricing, hesitant to enter payment details, or blocked by unclear error messages.

By combining qualitative insight with quantitative data, you can move from identifying a problem to confidently addressing it.

Attitudinal vs. behavioral research

Another useful way to think about UX research data is by separating what users say from what they actually do.

Attitudinal research captures users’ opinions, perceptions, and self-reported experiences. It’s about understanding what people think or feel about a product or concept.

Common attitudinal methods include surveys, interviews, and focus groups. These are especially useful early in discovery, when teams want to explore expectations, language, or perceived pain points. Product managers, researchers, and marketers often use attitudinal data to shape concepts and messaging.

Behavioral research, by contrast, focuses on observing real user actions. It shows how people actually interact with a product, often revealing gaps between intention and behaviour.

Usability testing, clickstream analysis, session recordings, and analytics all fall into this category. Designers, researchers, and engineers rely on behavioral data to identify friction, validate designs, and improve usability.

Importantly, attitudinal and behavioural data don’t always align. Users might say they find a feature intuitive, but struggle to use it in practice — or claim they’d use a feature that data shows is rarely touched.That’s why the most reliable insights come from combining both: understanding how users feel and validating those insights against what they actually do.

By mixing qualitative and quantitative methods, as well as attitudinal and behavioural data, teams can reduce bias, avoid assumptions, and build a more accurate understanding of user needs throughout the product lifecycle.

Which UX research method should I use?

With so many UX research methods available, it’s easy to default to what you already know — interviews, surveys, or usability tests — even when they’re not the best fit.

Rather than thinking in terms of individual techniques, it helps to start with a simple framework. The steps below can help product teams select methods that deliver the right insight at the right time.

1 - Define your questions and goals

Before choosing a research method, get clear on what you’re trying to learn. Are you exploring a new problem space, validating a design, or understanding why a metric has changed? Different questions call for different types of research.

If you’re trying to understand user motivations or unmet needs, qualitative methods like interviews or field studies are often more useful. If you need to prioritise issues, measure impact, or track changes over time, quantitative methods such as surveys or analytics may be a better fit.

Product managers, designers, and researchers often align on research goals together at this stage. Taking the time to define learning objectives upfront helps avoid running research that produces interesting insights, but doesn’t meaningfully inform decisions.

2 - Consider where you are in the product lifecycle

The stage of your product or feature plays a major role in determining which UX research process will be most effective. Research doesn’t need to be linear or rigid - certain approaches tend to work better at different points. But if you incorporate research at each of these stages, you stand a far greater chance of success.

Discovery

Early in a project, research helps teams understand who they’re designing for, what problems users face today, and where opportunities exist. At this stage, teams often ask questions like:

- Who are our users?

- What pain points do they experience with existing solutions?

- Why do people churn or fail to adopt?

- How do we differentiate from other solutions on the market?

Methods such as user interviews, surveys, diary studies, stakeholder interviews, and competitive analysis are commonly used here. This stage is especially valuable for product managers and researchers shaping strategy and defining problem spaces.

Explore and design

As ideas become more tangible, teams focus on refining solutions and testing assumptions. Common UX research questions include:

- Which concepts resonate the most?

- How do users expect this to work?

- Where might confusion arise?

Activities like persona creation, journey mapping, user story mapping, and co-creation workshops help teams align around emerging concepts.

Designers often lead this phase, working closely with cross-functional stakeholders.

Test

During development, research shifts toward validation. Teams want to know:

- Can users complete key tasks?

- Where do they struggle?

- Does this design work as intended?

Usability testing (in-person and remote), card sorting, A/B testing, and accessibility evaluations help designers, engineers, and QA teams identify friction and improve experiences before and after launch.

Listen (post-launch)

After release, research continues by monitoring real-world feedback and behaviour. Teams look for signals such as:

- What issues keep coming up?

- Where are users getting stuck?

- What’s changing over time?

Support tickets, social media monitoring, third-party reviews, analytics, search logs, and contextual enquiries help product and support teams spot recurring issues and inform iteration and roadmap decisions.

Thinking about research in relation to the product lifecycle helps teams choose methods that match their current needs, rather than applying the same approach everywhere.

3 - Consider the context of use

Finally, consider where and how users interact with your product, as this can influence which methods will generate the most reliable insights.

Some research methods work best in natural environments, where users behave as they normally would. Field studies, diary studies, and analytics are useful for understanding real-world behaviour and long-term usage patterns.

Other methods are more structured or scripted, such as lab-based usability testing, benchmarks, or controlled experiments. These are helpful when teams need to isolate specific interactions, compare alternatives, or evaluate performance against clear criteria.

There are also concept-level methods, like interviews, surveys, or concept testing, which don’t require a fully built product. These are especially useful early on, when teams are exploring ideas, language, or value propositions.

Most teams benefit from combining multiple approaches. Balancing real-world observation with structured evaluation helps reduce bias and ensures decisions are grounded in both context and evidence.

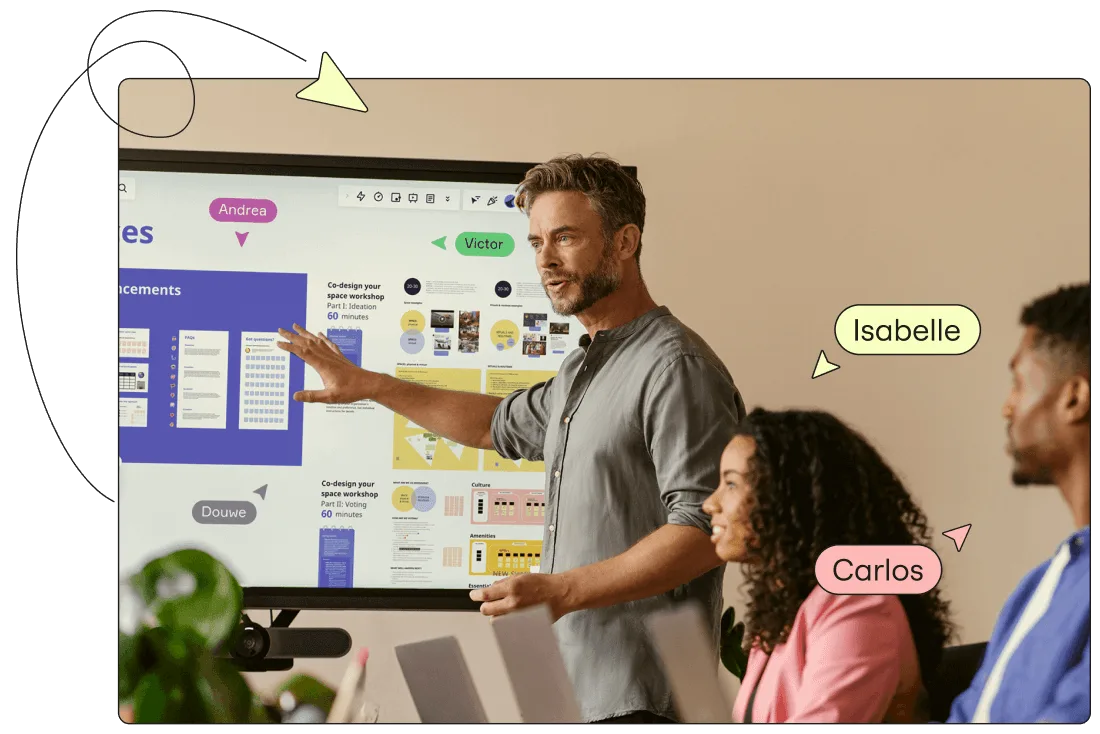

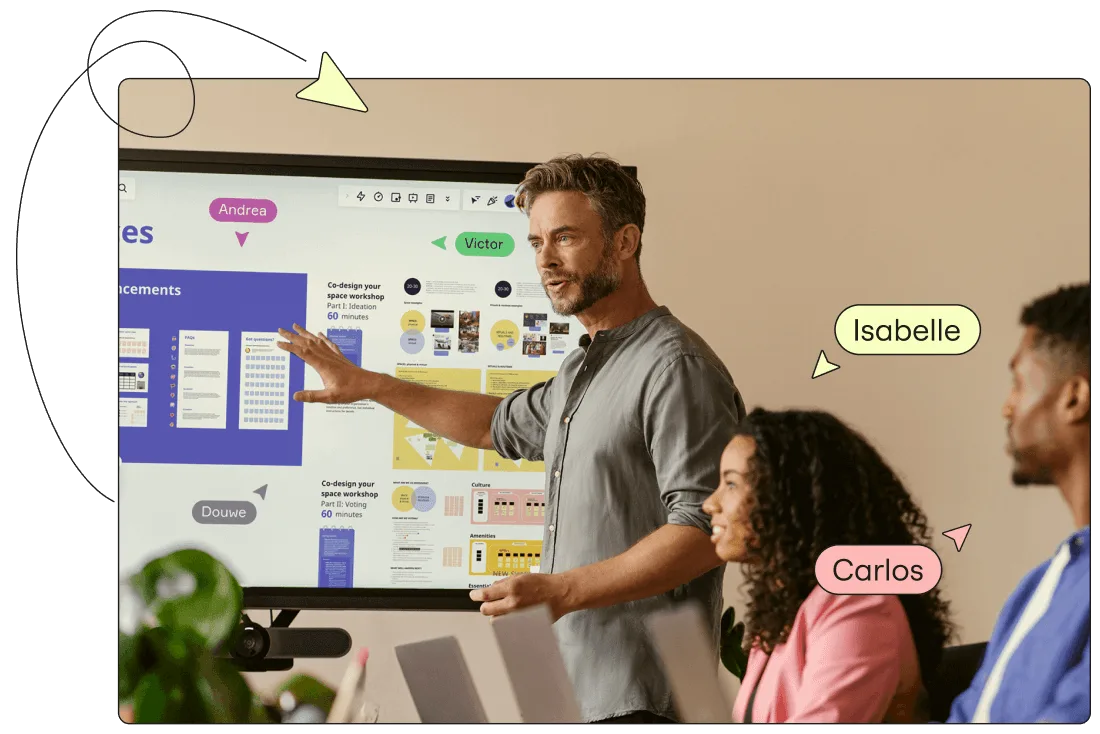

Structure your UX research with Miro

Running effective UX research isn’t just about choosing the right methods; it depends on having a shared structure that keeps teams aligned from first questions to final insights. When research lacks visibility or lives across disconnected tools, it’s easy to lose context, repeat work, or struggle to turn findings into action.

This is a common challenge highlighted in the 2025 Momentum at Work report. Knowledge workers spend three hours on meetings, admin, and email for every hour of focused, creative work — and 6 in 10 say silos stall momentum.

Miro gives UX and product teams a single innovation space to plan, run, and evolve research together, using shared UX research templates to capture goals, methods, timelines, and stakeholders in one place.

That’s how MELEWI, a travelling Product, UX, and UI design studio, runs end-to-end UX research with global clients. Avik Ganguli, a UX design consultant at MELEWI, highlights how the team uses Miro as a living research workspace.

They align on objectives and assumptions up front, then run focused research sprints like remote interviews and usability testing directly on the board. Insights evolve in real time, stakeholders stay involved asynchronously, and research flows naturally into design decisions instead of stalling in reports.

See how MELEWI runs remote UX research with MIRO.

Common UX research methods and tools

UX research methods vary in what they measure and when they’re most effective. The right approach depends on whether you’re exploring a problem, validating a design, or learning from real-world usage.

Below is a concise overview of common UX research methods, when to use them, and what type of insight they provide.

User interviews

Qualitative, mostly attitudinal. Use interviews to explore user motivations, workflows, and pain points in depth. Best used at project kick-off to shape problem understanding, and again later to check whether a solution meets user expectations.

Usability testing (moderated and unmoderated)

Mostly behavioural. Observe how users complete tasks and where they struggle in real time. Usability tests are best run early and often: from initial prototypes through pre-launch validation and after release.

Surveys and polls

Mixed quantitative and qualitative, and attitudinal. Use surveys to measure satisfaction, preferences, and trends at scale. Useful throughout the lifecycle, from early concept exploration to post-launch tracking.

Diary studies and longitudinal research

Qualitative, mixed attitudinal and behavioural. Capture experiences and behaviours over time to understand habits, routines, and long-term usage. Best when exploring new concepts or deepening insight into real-life product use.

Card sorting and tree testing

Card sorting: Qualitative, behavioural — explore how users group and label information. Best when defining or restructuring navigation or information architecture.

Tree testing: Quantitative, behavioural — test whether users can find information easily. Best early in a design or when validating new navigation structures.

Analytics and clickstream analysis

Quantitative, behavioural. See what users actually do in your product, where they drop off, and which paths they take. Best used continuously once you have live traffic.

A/B testing and experiments

Quantitative, behavioural. Compare design or content variants to determine which performs best against a key metric. Best used with live or beta traffic when teams need data to choose between options.

Customer feedback and support insights

Mixed attitudinal and behavioural. Use support tickets, chats, and reviews to identify recurring issues and themes. Best as an ongoing, post-launch source of real-world signals to guide investigation.

Field studies

Qualitative, behavioural. Observe people using your product or current solutions in their real environment to uncover context and unspoken needs. Best in early discovery and later, when validating designs in real-world settings.

Focus groups

Qualitative, attitudinal. Use moderated group discussions to explore perceptions, language, and reactions to ideas or concepts. Best early, when shaping concepts, messaging, or value propositions.

Five-second testing

Mostly quantitative, attitudinal. Capture first impressions of a screen or design within seconds to test clarity and messaging. Best in early design or prototype stages before committing to build.

Concept testing

Mostly qualitative, generative, and evaluative. Validate whether new product or feature ideas are understandable and worth pursuing. Concept validation testing is best before investing in development, and again when refining pre-launch messaging.

Start your next UX research project in Miro

Great UX research helps teams move beyond assumptions, reduce risk, and make better product decisions based on real user insight. Whether you’re exploring new problems, validating designs, or learning from live usage, research is most effective when it’s structured, collaborative, and easy to turn into action.

UX research doesn’t require a dedicated team to be effective. Many organisations embed research responsibilities across designers, product managers, and marketers — especially in smaller or fast-moving teams.

What matters most is a shared commitment to understanding users and acting on evidence.

Miro gives UX, product, and design teams a single innovation space to plan research, capture insights, and align stakeholders along the way. With UX research AI-powered capabilities, teams can speed up some of the most time-consuming parts - synthesizing interview notes, clustering qualitative data, summarizing patterns, and comparing competitors across products, features, and experiences - without losing human judgment.

This shared, visual approach also makes research easier to communicate across teams. As Philip McCusker, Product Manager at Munich Re, explains, “Miro works as a living knowledge base — capturing research findings visually and improving how insights are shared and understood across organisations.”

If you’re ready to bring more clarity and momentum to your research process, use Miro as your UX research tool and move from insight to action with confidence.

Author Josh Zak, UX-pert from Turtle Design

FAQs

How does Miro help UX research teams collaborate on projects?

Miro provides a shared workspace where UX research teams can plan studies, capture session notes, synthesize insights, and share findings in one place. Teams use boards to outline research goals, document interviews or usability tests, cluster qualitative data, and visualise patterns together.

Because everything lives on the same board, researchers, designers, and stakeholders can collaborate in real time or asynchronously, staying aligned as insights evolve.

How does Miro connect with tools like Jira and other research tools?

Miro integrates with tools like Jira, documentation platforms, and project management systems, making it easier to connect research insights directly to delivery work. Teams can link findings to tickets, track how insights influence decisions, and ensure research doesn’t get lost once development starts. This helps bridge the gap between discovery and execution.

How do I choose the right UX research method for my project?

Start by defining what you need to learn, then consider where you are in the product lifecycle, how much time you have, and how easily you can access users. Exploratory questions often call for qualitative methods like interviews, while validation and measurement benefit from behavioural or quantitative approaches.

In practice, combining methods usually leads to more reliable insight.

How much UX research is needed before I start designing?

You don’t need exhaustive research before you begin designing. A small, focused round of research is often enough to get started, as long as you continue learning as you design and ship. UX research works best as an ongoing process, not a one-time phase.

What’s the difference between generative and evaluative UX research?

Generative research helps teams explore new opportunities by understanding user needs, behaviours, and problems before solutions exist. Evaluative research focuses on testing ideas, designs, or products to see how well they work.

Most product teams use generative research early and evaluative research throughout design and development to refine solutions over time.